Plan your move to the cloud with Microsoft, Oracle, and AdInsure insurance software

To reap the full benefits of digital transformation, including improved efficiency, higher agility, faster scalability, and speed to market, insurers are increasingly looking at migrating to the cloud. However, one of the most widely cited concerns is the complexity of the migration of business-critical applications (such as insurance core systems) and cloud interoperability. To help insurers with the migration, we have developed robust Cloud capabilities, including support for hybrid operations, multiple vendors, and even multicloud deployments by leveraging the latest innovation – Oracle Database Service for Microsoft Azure.

Table of Contents:

- Our first foray into the cloud targeted Azure and hybrid setups

- Next stop Oracle

- Here comes the multicloud

In recent years, it has become apparent that there is no such thing as a Cloudless IT strategy, even in more conservative insurance regions. Something that started as an optional requirement within an RFI now became a real production thing. Cloud computing has enabled new customer experiences and driven significant investments that will reach $474 billion globally in 2022, according to a recent Gartner report. An O’Reilly survey has also revealed that 48% of companies plan to migrate more than half of their applications to the cloud, and 20% plan to migrate all of them.

Of course, not all migrations were created equal. For instance, deploying a new app onto the cloud is significantly simpler than moving a complete insurance software core system. For example, our AdInsure core system runs on a combination of Microsoft application servers and Oracle databases. Migrating a mission-critical system can be difficult and risky unless the vendors play well together.

Issues like this hold back cloud migration efforts in the insurance industry.

To support our clients as they undertake multi-line business migration projects, we implemented support for different public and private clouds, hybrid models (on-premise-cloud), and as of recently, even multicloud deployments.

Let’s look at how we are addressing this challenge.

Our first foray into the cloud targeted Azure and hybrid setups

We initially focused our cloud efforts on Microsoft due to our technology stack. Azure was our first target, and we added full support by leveraging native components, such as Azure SQL, Azure Kubernetes Services, and Azure Service Bus. Our first production cloud implementation was on the Azure public cloud.

A significant first step in supporting different cloud vendors was implementing support for .NET Core.

We also added support for hybrid implementations to deliver as much flexibility as possible. For example, we have a production implementation where the core part of AdInsure remains on-premise. At the same time, the B2B distribution channel portal (including features such as Policy Administration), the multi-channel rating engine, and Sales modules were deployed to the Azure Managed Cloud. Modular architecture and natively integrated modules that support such a hybrid architecture are important parts of our cloud support.

Next stop Oracle

Oracle is another essential piece of our technology stack puzzle of many insurance solutions, including our own AdInsure. Since so many insurers rely on Oracle’s critical database infrastructure, we have always ensured that our AdInsure software runs well on these platforms

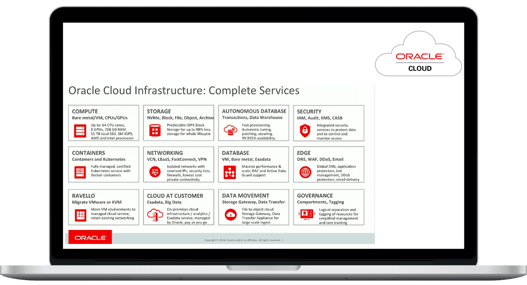

In 2022, we added support for deployments to Oracle Cloud infrastructure to offer wider Cloud choice. Oracle-specific features include Oracle Autonomous Database, Container Engine for Kubernetes, and automated deployment using Terraform and Helm tools.

This year, Microsoft and Oracle expanded their cloud partnership to deliver Oracle Database Service for Microsoft Azure. Users can now connect their Azure and OCI subscriptions and easily configure everything required to link the two environments. In practice, administrators can use Azure to provision OCI databases and treat them like an Azure resource.

With this newly introduced functionality, insurers can use OCI Autonomous Databases with all Azure Analytics tools and any Azure App (App Services, Kubernetes, Visual Machines, containers, etc.). This gives them a rich toolset for high availability and immensely scalable Oracle databases.

With our Q3/2022 release, we added full support for Oracle Database Service for Microsoft Azure, allowing easy deployment of AdInsure cloud Insurance software into multicloud environments comprising Microsoft Azure and Oracle Cloud. This release positions us as the first vendor to fully support the Oracle-Microsoft multicloud.

We are building on several years of efforts and partnerships with the two cloud giants. We want to ensure insurance companies can freely choose the technology to run their software while making it cloud-ready and simple to migrate to the cloud environment and rip the benefits through transformation.