Insurance companies and the move to AI

The overall rise of AI Is driven by positive sentiment and increasing computation power. Over the past few decades our relationship with Artificial intelligence (AI) has been a positive one. Going from a frightening “Big brother”- like technology, to a global transformative force, reshaping and adding value to hundreds of businesses.

As computing power has increased, AI training costs decreased, machine learning became more common and other advancements, such as the move to cloud computing, algorithmic innovations, and improved data quality, have also contributed to the rise in artificial intelligence.

If we measure the amount of AI needed to train a model in terms of so-called “compute”1, the amount of computing needed to train a neural network has been decreasing by a factor of 2 every 16 months, since 2012. It now takes 44 times less computing to train a neural network. This means that both AI usage and efficiency are exponentially increasing.

Table of Contents:

- Customer Services and Claims are driving the AI adoption in Insurance

- AI investments provide tangible benefits

- Every AI roadmap requires a data-driven culture change

- Insurance is one of the most data-intensive and data diverse industries

- The AI journey starts with the right data being in place

Customer Services and Claims are driving the AI adoption in insurance

AI has been a major disruptor across many major industries, including healthcare, retail, e-commerce, travel, and logistics. In banking and financial services, the transformation is more visible, with personalized customer service, creditworthiness checking, natural language processing, cybersecurity, and risk management.

The insurance industry, traditionally slow in adopting new technology, even lagging behind banks, is now beginning to use AI. According to Gartner Research, the use of AI continues to spread throughout the industry, with many companies only starting their AI journeys and others well on their way to full usage. For example, in the 2022 Gartner CIO and Technology Executive Survey, approximately 35% of insurance CIOs reported they were increasing their investments, and 61% rated AI as providing superior or high value in responding to industry trends.

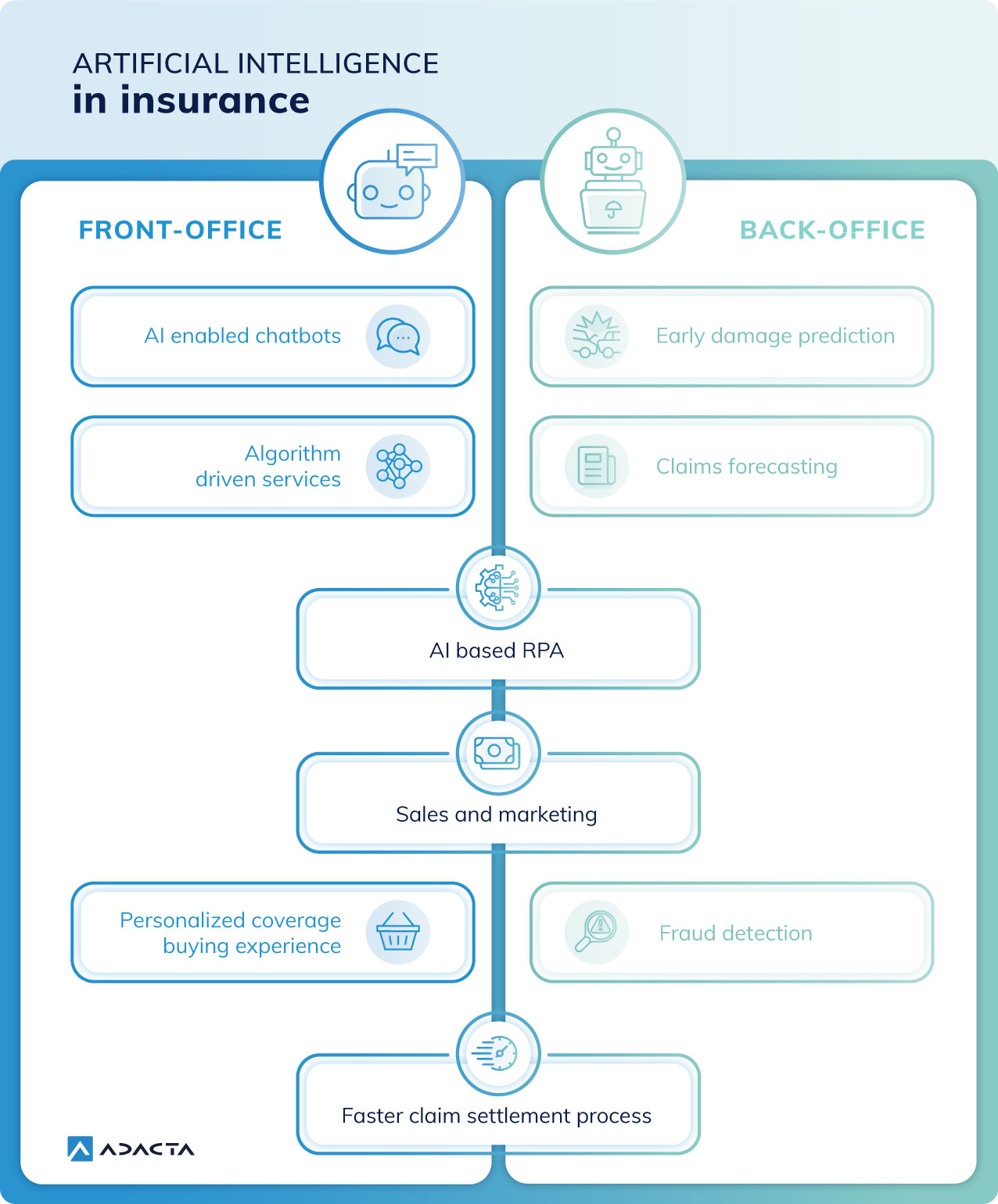

The most common use for AI in the insurance industry is the process of claim handling. AI can be used to reduce manual data entry as well as simplify claims processing by using advanced AI techniques to automate visual intelligence in the motor and home insurance spaces. In terms of claims, machine learning techniques such as text mining and natural language processing (NLP) provide simpler algorithms and define clearer use cases.

AI is also used to create a better customer experience, for example, chatbots are very common throughout the industry to create a better customer experience. Supporting customers 24/7 with predefined answers for FAQs and answering complicated questions thanks to machine learning.

Other customer-centric uses of AI include policyholder loyalty, upsell, profile, metadata for forecasting, etc. As we can see, applying and developing machine learning and AI is a never-ending process. There is always room for increased functionality and value provided by AI.

AI investments provide tangible benefits

So where are AI investments paying off for insurance companies? According to the PWC report: “AI for insurers in 2021” insurers already invested in AI, are reaping the benefits. Almost two-thirds report success in using AI to create a better customer experience (CX). Nearly half say AI is helping improve decision-making. Yet many insurers who seek to deploy AI are getting stuck — usually in the same places.

Real AI applications are scattered across various small-time insurance providers and specific in-house solutions. Smaller startups have a lot of knowledge in the computer sciences, but limited domain expertise. To build an in-house solution, insurance companies aggregate and connect data sources of differing quality.

As insurance companies make acquisitions, the data problems worsen when merging data from different providers. The main issue when building a common data source is therefore data availability and quality.

Picture: Artificial intelligence in Insurance

Every AI roadmap requires a data-driven culture change

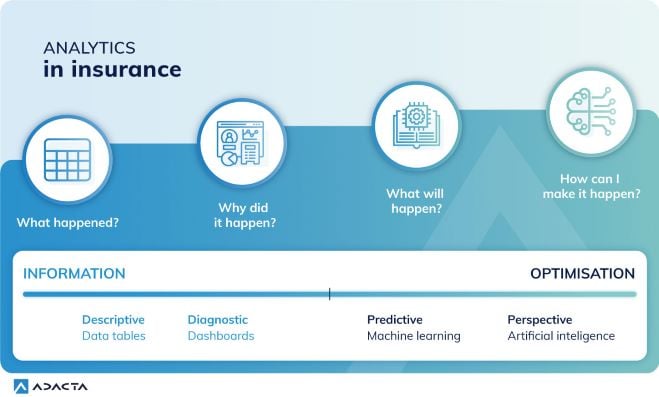

Currently, the focus of the insurance industry is moving from a data to model-based company culture. The move from data analytics to the more advanced machine learning/AI frameworks must include educating employees on using the data effectively.

Data analytics is more commoditized, such as existing dashboard and reporting functionality. There is also an opportunity to combine reporting and visualization with AI. We could say that business intelligence is more about “keeping the lights on” and AI - driving the business forward.

Picture: Analytics in insurance

Insurance is one of the most data-intensive and data-diverse industries

Core insurance systems are generating massive amounts of data that are not being sufficiently utilized. This data should be leveraged for automating simple/repetitive tasks or for smarter decision-making. One of the main problems insurers face today is enterprise-wide scalability when joining separate AI business users into a unified insurance landscape.

Operationalizing newly built models is key to realizing business value, and the ability to do it at scale creates a strategic advantage. Resources are required to source data, manage models, and create real-time integration with core systems. Therefore, a DIY approach is not always the most effective. Embedding advanced analytics into the process is very difficult.

The AI journey starts with the right data being in place

Generated core system data is more structured and centralized than existing company data, which is generated from multiple systems. At Adacta, we’re working towards a core system that understands system data, extracts it in real-time, cleanses, catalogs, and curates it for use.

However, model results need to be integrated into the core systems with appropriate screen updates, business rules, and workflow changes to deliver value. Therefore, we are building a Insurance platform that provides the building blocks for creating an end-to-end advanced analytics solution.

With this in mind, the insurance company doesn’t have to worry about many programming languages, tools, and technologies needed to achieve this task.