Are you ready for IFRS 17?

Table of Contents:

- Our clients tell us IFRS 17 compliance is complex

- Band-aid fixes and temporary workarounds will not work

- The main pain points of insurers

- The two questions that will direct IFRS 17 efforts

- AdInsure as the core system driving IFRS 17 compliance

- Do not delay

- So, where are we today?

- FAQ

Our clients tell us IFRS 17 compliance is complex

You hear things when you’re an insurance platform provider. As we help insurers modernize and update their legacy IT systems, we recently saw that much of these efforts had been aimed at achieving or supporting IFRS 17 compliance. Since our consulting activities and technology solutions support these initiatives, we are in the thick of it.Band-aid fixes and temporary workarounds will not work

IFRS 17 is the end result of two decades of negotiations and its ambitious goals reflect that. It aims to introduce a comprehensive principle-based framework to account for all types of insurance contracts, to drive improved transparency and standardisation in financial statements and to ensure a better alignment of the insurance industry accounting with IFRS accounting principles.

It was created to provide all stakeholders with the ability to review insurance companies with transparent and comparable financial information. The benefit of insurers using the same standard across the world is improved understanding of insurance companies’ current activities, future objectives and global position. This allows insurance customers as well as investors to better understand the financial strength of individual insurance companies by analysing a unified financial report.

IFRS 17 requires insurance companies to overhaul processes across their operations. This requires a comprehensive approach. Band-aid fixes or short-term solutions will not work. The failure to adopt the new processes will lead to bottlenecks and errors, while the worst is that companies will not achieve the long-awaited compliance.

The main pain points of insurers

As we work in the market and with our clients, we see the insurance industry is making progress with their plans for IFRS 17, but this progress is happening at different speeds. This process is so very complex that the effective date for IFRS 17 rollout has been deferred from 1 January 2021 to 1 January 2023.

And what are the main issues shared by our clients? Their analyses in preparation for IFRS 17 reveal the following issues when it comes to providing data from source systems on which insurance companies are running.

- Multiple source systems for individual core modules. Legacy technologies often mean that core business modules, such as Policies, Claims, Commissions and others are running on separate systems that might not deliver standardized data or could be difficult or costly to integrate.

- Lack of granularity. IFRS 17 requires granular data models that support the measurement of homogenous groups with shared attributes. Legacy systems do not provide this making it difficult for insurance carriers to achieve compliance.

- Traceability and audibility. IFRS 17 requires all data and calculations to be transparent and auditable. In practice, this means that every step in a process should be documented consistently and across the entire system.

The two questions that will direct IFRS 17 efforts

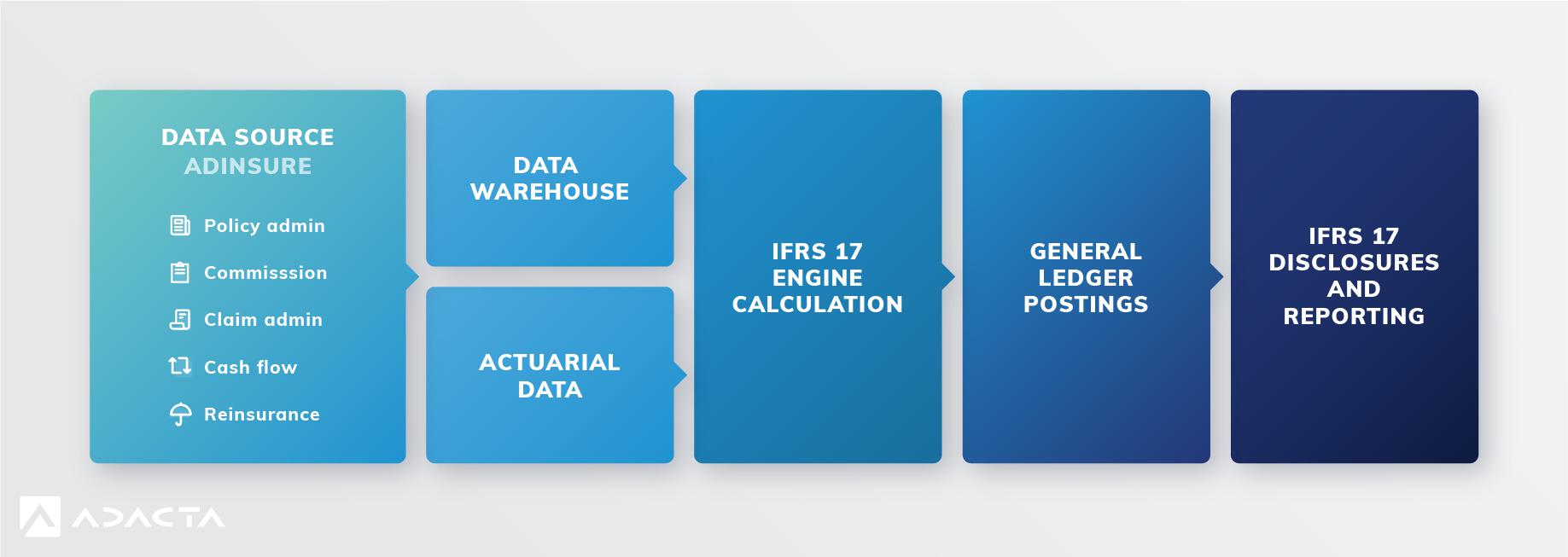

When it comes to technology solutions, the IFRS 17 journey usually starts with understanding the expected outputs of IFRS 17 and working backward through the systems to identify the key dataflows that form the basis of the final disclosure and reports. The most important thing then is to understand the end game, which is what IFRS 17 Disclosure and Reporting means.As a technology company, we had to adapt to the new reality. On the consulting side, we help clients scope the range of activities, while on the technology side, much data is generated by the business modules of our solution. This means we needed to read up on IFRS 17 to understand its impact and our role in it.

In the end, we had focused our thinking and efforts on two simple questions: What data do we need in order to meet IFRS 17 requirements and, more importantly, what data do we have?

The key to success lies in finding answers to these two questions. While simple, these questions allow insurers to clearly formulate their vision and then gather relevant requirements and analyse them to be able to provide accurate and validated inputs in proper form.

AdInsure as the core system driving IFRS 17 compliance

In addition to delivering a predefined IFRS 17 data model and flexible approach to data storage, AdInsure provides robust data feeds, a set of predefined rules to aggregate and post data and the ability to both integrate with the IFRS 17 engine, general ledger and actuarial models to load all relevant data and create an audit trail to track results.

Do not delay

To produce IFRS 17 outputs, insurers will need to collect and process a high volume of data coming from different sources (premiums, claims, reinsurance and cash flow) with increasing levels of granularity and depth.

Without automated software features that track the data history, insurance employees will have to invest enormous manual effort and investigation. Don’t get me wrong, spreadsheets are great, but relying on spreadsheets alone is a great way to get into trouble.

So, where are we today?

We see insurers who want to be ready a year in advance and do a dry run over the complete 2020 financial statement. Others may opt for the “big bang approach” and wait until the last moment. Whatever the strategy, there is a trade-off between certainty and cost.

What does IFRS 17 mean for insurance organisations?

IFRS 17 represents one of the biggest and most significant insurance accounting changes in several decades. This standard is much more than a simple accounting change or a regulatory compliance exercise. It is a radical change whose impacts will run wide and deep across finance, risk, actuaries, and IT.

Where can I find more information about IFRS 17?

For the latest information visit the IFRS website.

Business Analyst

Nikola Aleksić is a valuable member of the business analysis team, mainly dealing with accounting processes optimisation.

View profile