AdInsure Agent Portal – the perfect companion for crossing the social distance barrier

The right technology can help insurance agents stay close to their customers even in times of social distancing. The perfect tool to accommodate the features outlined in our previous article about selling life insurance in times of social distancing is the agent portal. Let’s take a closer look at how the AdInsure Agent portal, part of the AdInsure insurance platform, facilitates agents’ work.

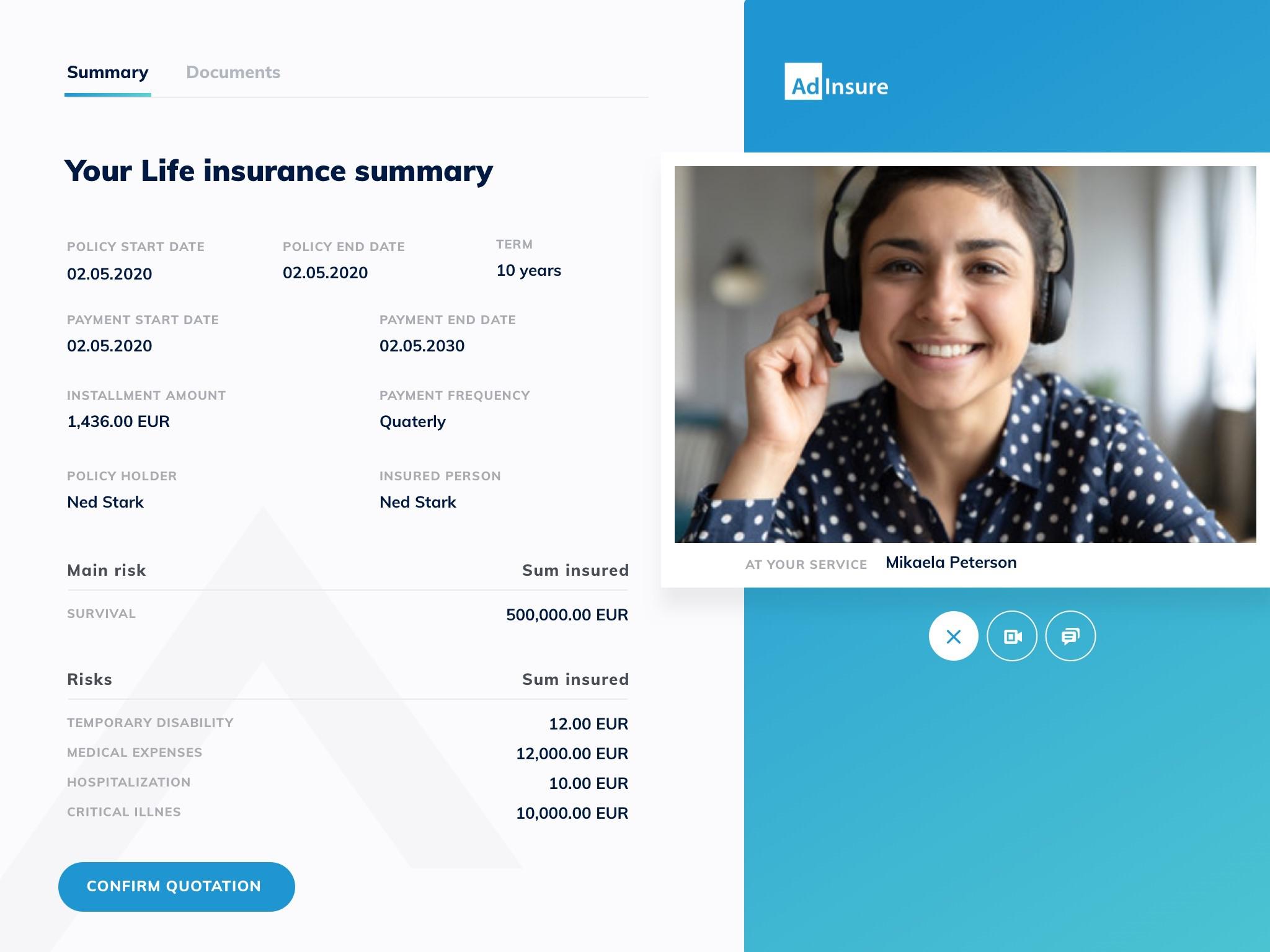

Video-based interaction

The agent can make a video-call to the client from their work environment on the AdInsure agent portal. The portal features a dashboard with leads to follow-up. Clicking on a lead initiates video communication by sending a link by e-mail or text message to the client. By clicking the link, the client joins the video call, that delivers an experience similar to that of Zoom or Microsoft Teams. Video brings people closer giving the client and the agent an opportunity to discuss the offer freely.

Although screen sharing through video is possible, we believe that presenting the agent’s screen to the client (agent’s dashboard) is not the best way to showcase a sales proposal. It may be too cluttered and too complicated, which is why we have introduced content sharing.

The client’s view

While working out the proposal, changing the coverage options, terms and conditions, the agent can share a simplified overview of the proposal with the client. With a click of a button on the agent’s dashboard, the client receives a link to the shared content page via the integrated chat.

When the client clicks on the link, the browser presents a customized proposal overview. This is an embedded HTML5 page served by the agent portal - the “Client Summary” page. Any changes carried out by the agent are instantly reflected in the client’s proposal overview. The agent and client are looking at the same content, but the client’s view is edited for simplicity and clarity. As they discuss the offer, the agent can continue to tweak the offer according to client’s needs and the client will instantly see an updated summary.

Contract conclusion – Identification and signature

At any time, the agent can send various calculations, illustrations or other documents in PDF format to the client’s email address for review. The documents are also instantly available through the Client Summary page, so the client does not have to leave the environment to use another application.

The AdInsure Agent portal is not limited to enabling a conversation with a client and providing guidance through the sales process. It also provides the ability for the agent to close the sale. If a client is not physically present at the point of sale and still wants to conclude the process remotely, they must be identified first. Third-party integration provided by the AdInsure Agent portal enables remote eIDAS-compliant video identification. After the identity is confirmed, the last step of the process is a digital signature of the quote and the related documentation which can be performed from the comfort of the customer’s home.

Looking at other industries

If you need convincing, other industries already support handling client relationships remotely. Insurers should look no further than fully digital banks, such as N26, that allow you to open a bank account from the comfort of your home. The necessary technology has been available for some years already and now is the right time to bring all pieces together and offer an end-to-end solution, capable of serving the sales process anytime and anyplace. COVID-19 has made doing business remotely socially acceptable. Insurance companies should seize the opportunity to reduce costs and increase productivity at the same time.